Objection Reason Objection marked - [UID number already exists for another PAN].

There is a solution to this problem, information about it has been given below, you can see and solve the error.

{tocify} $title={Table of Contents}

If you are also getting such an error, then how can you find out whether we already have a PAN card or not?

UID number already exists for another PAN

Are you also getting to see the status of objection marked - uid number already exists for another pan on checking the PAN card form status, and how can you fix the UID number already exists for another pan in the objection region?

Step 1:- First of all, we have to find out whether the Aadhaar card number given while making our PAN card is linked to any PAN card or not, that is, whether a PAN card is made from that Aadhaar card or not.

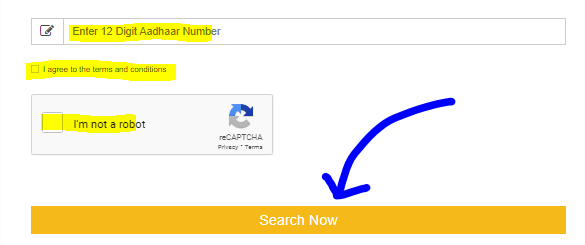

Step 2:- First of all you have to click on this link https://onlineseva.xyz/searchpannumberbyuid.php to check, From here you can check whether PAN card is generated with Aadhaar or not.

Step 4:- Here you can see that your PAN card is generated from UTI, this is Aadhaar number, as well as you get to see Short/Hidden PAN Number, now you are confirmed that your PAN card is generated, whose PAN card The number will be visible in front of you.

Objection marked - [UID number already exists for another PAN].

If you receive a message that says "UID number already exists for another PAN" when applying for a new PAN (Permanent Account Number), it means that the Aadhaar number you have provided is already linked to another PAN. Each individual can have only one PAN linked to their Aadhaar number.

Here's what you can do to resolve this issue:

1. Verify your Aadhaar-PAN linkage: First, verify whether your Aadhaar number is already linked to a PAN by visiting the Income Tax Department's e-filing website (https://www.incometax.gov.in/iec/foportal/) and clicking on the "Link Aadhaar" option. If your Aadhaar is already linked to a PAN, you will see a message stating the same along with the PAN number.

2. Rectify the Aadhaar-PAN linkage: If your Aadhaar is already linked to a PAN that you no longer use or do not recognize, you will need to rectify the Aadhaar-PAN linkage. To do this, visit the Income Tax Department's e-filing website and click on the "Link Aadhaar" option. Then, enter the PAN number that is currently linked to your Aadhaar and follow the instructions to delink it. Once the PAN is delinked, you can apply for a new PAN using your Aadhaar.

3. Apply for a new PAN: Once you have verified that your Aadhaar is not linked to any other PAN or rectified the linkage, you can apply for a new PAN using your Aadhaar. Make sure to provide accurate information and supporting documents to avoid any delays or issues with your application.

If you continue to face issues or have any questions regarding your PAN application or Aadhaar linkage, you can contact the PAN/TIN call center at 020-27218080 for further assistance.